by Teresa Marzolph | Jan 26, 2018 | Employee Engagement

Today, Culture Engineered officially launches a survey focused on assessing the employee experience for educators as it relates to school performance. The process began in fall of 2017 when a staggering number of requests were received from schools around the US in...

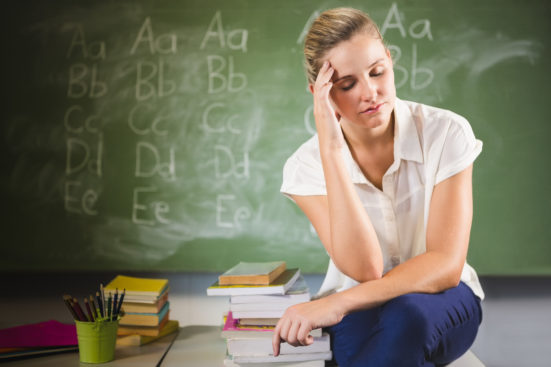

by Teresa Marzolph | May 19, 2017 | Compliance

Are your independent contractors actually employees? Guidance from the IRS and DOL. IRS guidance. The IRS focuses on the following three “common law rules” to distinguish independent contractors (IC) from employees: Behavioral: Does the company control or have the...