Culture Engineered Knowledge Hub

Restoring human connection in the workplace

WHERE HAVE ALL THE TEACHERS GONE…..AND WHAT ARE SCHOOLS DOING TO KEEP THEM?

According to a report by the Learning Policy Institute, four leading factors, contributing to a national teacher ...

5 MYTHS ABOUT THE AZ PAID SICK TIME LAW SOON LEADING TO PENALTIES

On November 18th, 2016, Arizona’s Fair Wages and Healthy Families Act (Prop 206), passed with high voter approval ...

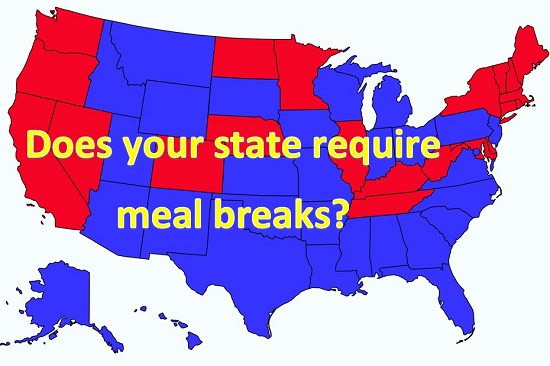

When is break time?

Why do you offer breaks to your employees? Is it good for morale? Does it help ensure better quality? Well, for 21 ...

LOOKING FOR A NEW CAREER OPPORTUNITY? WHICH SOUNDS IDEAL TO YOU?

Option 1:

Amazing travel benefits for you and your family (although you may want to hold off on booking that ...

Paid Sick Time Required for AZ Employers….the silent but potentially deadly hidden dangers of Prop 206

Late yesterday, the Arizona Supreme Court ruled to uphold the previously challenged Prop 206, a law passed by ...

Are you discussing these 2 things with your employees? No worries if you’re not – they’re probably leaving you anyway.

Gallup’s recently released State of the American Workplace report shows that more than 51% of employees are ...

No results found.